Calamos Pioneers CAIQ: The First Nasdaq-100 Autocallable Income ETF

Metro Chicago, Illinois, November 19, 2025– John Koudounis, President and CEO of Calamos, a leading alternatives manager, today announced the launch of Calamos Nasdaq® Autocallable Income ETF (CAIQ), the first ETF to deliver an autocallable income strategy on a Nasdaq-100® based index, exhibiting a current weighted average coupon of 17.98%.1 CAIQ will begin trading tomorrow, Thursday, November 20th.

“Calamos is driving the autocallable income revolution in the ETF marketplace, as demonstrated by the success of CAIE and now the launch of CAIQ. Building the definitive Autocallable ETF franchise is exactly the kind of genuine innovation that has defined Calamos for decades. We don't follow trends, we create them,” said John Koudounis.

Read Full Press ReleaseFrom Complexity to Accessibility: Democratizing Autocallable Yield Notes Through ETF Innovation

Why Calamos Autocallable Income ETFs

High Stable Monthly Income Potential

Coupons typically higher than bonds, tied to equity market performance

Tax Efficient ETF Wrapper

Seeks favorable tax treatment on distributions vs. ordinary income

Model-Portfolio Ready

Single ticker solution, liquid, and operationally efficient

Laddered Exposure

52+ autocallables seek consistent income and reduced timing risk

The Appeal for Autocallables is Clear

Attractive high stable income derived from equity market parameters rather than credit risk or duration—providing a genuinely diversified income source.

Chart source: Bloomberg and Morningstar Direct. Data as of 10/1/2025.

Unmanaged index returns, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. Total return assumes the reinvestment of income. Current performance may be higher or lower than the performance data shown. Yields represented by trailing 12-month yield for: Top Derivative Income Funds (Represented by the top 10 Funds by AUM as of 9/30/25 in the derivative income category excluding single stock funds) and yield to worst for the Bloomberg Aggregate Bond Index, Bloomberg US Corporate Index and Bloomberg US Aggregate Corporate High Yield Index. Yield represents weighted average coupon for: MerQube US Large Cap Vol Advantage Autocallable and MerQube Nasdaq-100 Vol Advantage Autocallable Index. Investors should consider the risks of investing in CAIE and CAIQ and review the prospectus prior to investing. Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value of an investment will fluctuate so that your shares, when sold, may be worth more or less than their original cost.

The $200 Billion Derivative Income Revolution

Investor demand for diversified sources of income has fueled explosive growth in derivative income strategies, which now exceed $200 billion across ETFs ($114B) and structured notes ($104B). In ETFs, covered call strategies dominate the category, but across the structured note landscape, autocallables account for nearly 70% of all issuance.

Data as of 12/31/24. Autocallable note issuance data source: J.P. Morgan and Structured Retail Products, as of 12/31/24. Derivative Income Funds AUM data source: Morningstar, as of 12/31/24. “Derivative Income” is categorized by Morningstar as encompassing ETFs and mutual funds that primarily use options to generate income, typically through strategies like covered call writing. Past performance is not indicative of future performance.

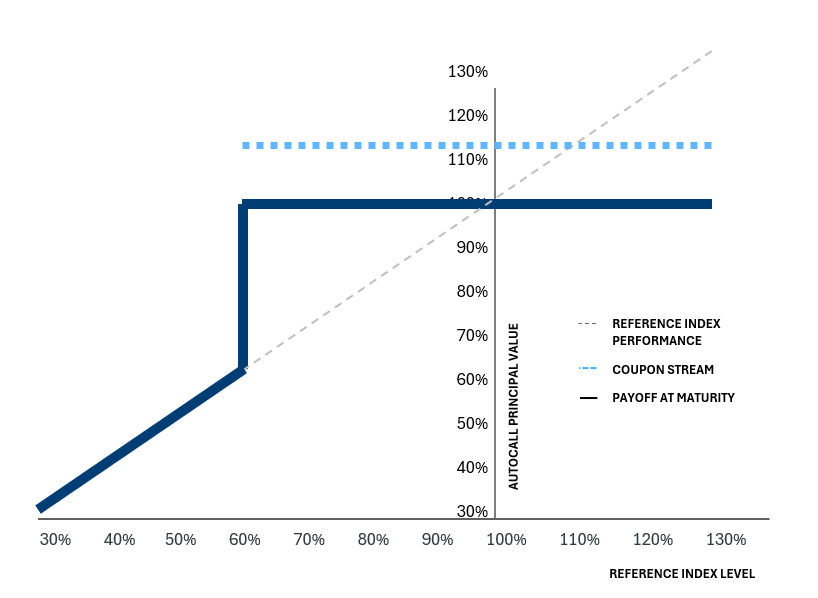

What Is An Autocallable?

An autocallable is a market-linked instrument that pays regular coupons and returns principal at maturity (or if called early), as long as a reference index, like the S&P 500, doesn't fall below specific thresholds (e.g., -40%)—think of it like a bond whose income and principal depend on the stock market not falling too far.

The trade-off is simple: monthly income potential typically greater than traditional fixed income, in exchange for the risk that a severe market downturn could interrupt your coupon payments or, in the worst case, result in principal loss.

This is illustrated in the chart above. Coupons are paid (blue dots) so long as the underlying reference index is above the -40% barrier, and principal is only at risk if the reference index falls below -40% at maturity.

Source: Calamos Investments LLC. For illustrative purposes only. Not representative of any investment product. Past performance is no guarantee of future results. Although an autocallable is designed to incur incur no loss if the reference index is above the maturity barrier at expiration, the interim value of an autocallable will fluctuate as it is continually marked to current reference index prices.

Three Powerful Portfolio Applications

Equity Alternative

Yield Enhancement & Diversification

Tax Efficient ETF Wrapper

Harness the Power of Three Global Leaders: J.P. Morgan, MerQube, and Calamos

CAIE is based on a proven autocallable strategy popularized by J.P. Morgan and MerQube. More than $3B in assets are already invested in J.P. Morgan autocallable notes tied to the MerQube Vol Advantage Index. Calamos has collaborated with both partners to deliver similar exposure through a laddered ETF structure, making it accessible to all investors.

The collaboration combines:

- J.P. Morgan

Balance sheet strength and structuring power - MerQube

Quantitative indexing expertise - Calamos Investments

Alternatives and risk management expertise

A Reference Index Designed for Autocallables

CAIE and CAIQ reference MerQube Indexes—MQUSLVA and MQAUTOQL, respectively—benchmarked and optimized specifically for autocallable performance:

- Volatility targeting helps create predictable income streams

- S&P 500 & Nasdaq-100 focus ensures liquidity and transparency

- Single index clarity avoids complex "worst-of" structures

Since 2021, MerQube has emerged as the preferred index provider for leading autocallable issuers such as J.P. Morgan-earning recognition as "the future of the autocallable space" for its ability to enhance income potential and stabilize performance.

Learn more here: https://merqube.com/indices/MQUSLVA and https://merqube.com/indices/MQAUTOQL