Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, January 2026

Introduction by John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

We believe there are many reasons for investors to be optimistic as 2026 begins. Companies around the world are seizing opportunities supported by secular and cyclical growth tailwinds, as they adapt to an evolving tariff landscape. In the US, interest rates are moving down, and fiscal policy has provided greater clarity and a more business-friendly regulatory and tax environment. We’re seeing more fundamentally driven markets and improved prospects for companies across the capitalization spectrum—including small and micro caps.

Alternatives for Asset Allocation

- AC Private Markets-Private Credit, Private Equity and Hedged Strategies

- Protected Bitcoin ETFs

- Structured Protection ETFs

- Autocallable ETFs

- Alternative Mutual Funds

Investment opportunities abound worldwide. Favorable macro conditions are driving growth in developed and developing markets, as countries implement stimulative policies and reward corporate innovation. Many region-specific themes are strengthening, such as defense spending in Europe.

Another positive trend centers around the expansion of opportunities within the financial markets. This spans the gamut from an extraordinarily strong year in the global convertible market, where we saw near-record-breaking issuance of more than $166 billion, to new investment solutions that provide investors with groundbreaking tools for enhancing returns and managing risks. We are committed to staying at the forefront of these innovations, building on our pioneering alternative mutual fund capabilities through private market strategies and a range of ETFs, including protected bitcoin, structured protection, and autocallables.

Lessons from 2025 for the New Year

Market performance in 2025 reinforced several key lessons for investors—about the benefits of diversification, the resilience of the markets, and the value of a long-term perspective and effective risk management.

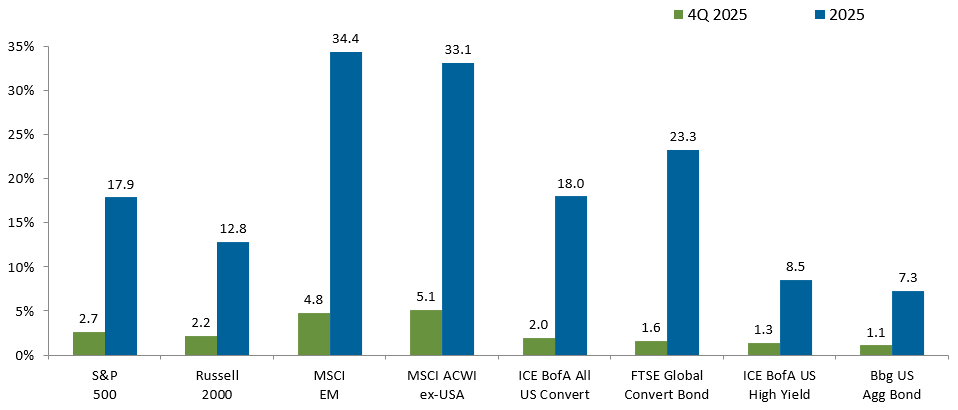

For the year, most major benchmarks delivered strong gains. Investors who embraced global diversification are likely in especially good spirits—while US large and small caps delivered double-digit returns, international markets performed even more strongly. Similarly, the global convertible market surpassed the healthy advance seen in the US convertible market.

2025: A Year of Robust Gains Across Global Asset Classes

Source: Morningstar. Past performance is no guarantee of future results.

Returning to the idea of resilience and long-term perspective, I’d encourage investors to remember that these gains were certainly not earned in a straight line. There were many ups and downs along the way, from tariff shocks and a US government shutdown to alternating waves of fear and enthusiasm regarding AI, corporate earnings, inflation, and monetary policy.

The key takeaway is that markets are often very volatile in the short term, even as they advance over the longer term. I expect volatility to remain elevated in 2026, especially as the US midterms come into focus. Fiscal policy is a key driver of economic policy, and a changing political landscape can have far-reaching repercussions for businesses, households, and the markets.

I believe the best way for investors to navigate continually evolving market conditions is through thoughtful asset allocation, built around an array of actively managed strategies. By combining a variety of funds to meet your own specific risk tolerance, you’ll avoid the temptation to try to time the market—and as you’ll read in our commentaries below, there are many reasons to stay invested for the long term.

2026 Begins the Second Half of a Very Different Decade

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

CMNIX: A Flexible Approach Yields Historically Consistent Results

Calamos Market Neutral Income Fund (CMNIX)

Jason Hill

Once Again in 2025, CIHEX Performs as Designed

Calamos Hedged Equity Fund (CIHEX)

Jason Hill

Convertible Securities Carry Strong Momentum into 2026

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA and Joe Wysocki, CFA

Global Convertibles: Strength in 2025, Optimism for 2026

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

The Cycle Prevails: Why Fundamentals Should Dominate Valuation Concerns

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

Why Growth Equities Can Power Ahead in 2026

Calamos Growth Fund (CGRIX)

Matt Freund, CFA and Michael Kassab, CFA

Top-Notch Timpani Performance in 2025, Superb Small-Cap Setup in 2026

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

Tailwinds Ahead: Cyclical Drivers and Secular Innovation in 2026

Calamos Global and International Suite

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA and Kyle Ruge, CFA

Solid Ground, Shifting Winds: Navigating a Nuanced Credit Market

Fixed Income Suite (CIHYX, CTRIX, CSTIX)

Matt Freund, CFA, Christian Brobst and Chuck Carmody, CFA

Diversified, Quality-Focused Portfolios Well-Positioned for 2026

Calamos Antetokounmpo Sustainable Equities Fund (SROIX)

Jim Madden, CFA, Tony Tursich, CFA and Beth Williamson

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, are not available for direct investment, and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes, and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World ex USA Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA US High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The FTSE Global Convertible Bond Index measures the performance of the global convertible. The Bloomberg US Aggregate Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

Calamos Structured Protection ETFs. There is no guarantee the Fund will be successful in providing the sought-after protection. The outcomes that the Fund seeks to provide may only be realized if you are holding shares on the first day of the Outcome Period and continue to hold them on the last day of the Outcome Period, approximately one year. There is no guarantee that the Outcomes for an Outcome Period will be realized or that the Fund will achieve its investment objective. If the Outcome Period has begun and the Underlying ETF has increased in value, any appreciation of the Fund by virtue of increases in the Underlying ETF since the commencement of the Outcome Period will not be protected by the Buffer, and an investor could experience losses until the Underlying ETF returns to the original price at the commencement of the Outcome Period. Fund shareholders are subject to an upside return cap (the "Cap") that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Fund's website, www.calamosadv.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The principal risks of investing in the Calamos Autocallable Income ETF include: autocallable structure risk, contingent income risk, early redemption risk, barrier risk, authorized participant concentration risk, calculation methodology risk, cash holdings risk, correlation risk, costs of buying and selling fund shares, counterparty risk, credit risk, derivatives risk, equity securities risk, index risk, interest rate risk, investment in a subsidiary, laddered portfolio risk, liquidity risk, market maker risk, market risk, new fund risk, non-diversification risk, premium-discount risk, secondary market trading risk, swap agreement risk, tax risk, trading issues risk, valuation risk, and volatility target index risk.

Autocallable Structure Risk–The Fund’s returns are correlated to the performance of a synthetic portfolio of autocallable notes tracked by the Laddered Autocall Index. Autocallable notes have specific structural features that may be unfamiliar to many investors:

–Contingent Income Risk: Coupon payments from the Autocalls are not guaranteed and will not be made if the Underlying Index falls below the Coupon Barrier on observation dates. This means the Fund may generate significantly less income than anticipated during market downturns.

–Early Redemption Risk: Autocalls in the Portfolio may be called before their scheduled maturity if the Underlying Reference Index reaches or exceeds the Autocall Barrier on observation dates. This automatic early redemption could force reinvestment of that portion of the portfolio at lower rates if market yields have declined.

Calamos Aksia Hedged Strategies Fund. Because the Fund invests in multiple Alternative Funds, an investment in the Fund will be affected by the investment policies and decisions of the Underlying Manager of each Alternative Fund in direct proportion to the amount of Fund assets that are invested in such Alternative Fund. The value of the Fund's assets may fluctuate in response to, among other things, various market and economic factors related to the markets in which the Alternative Funds invest and the financial condition and prospects of issuers in which the Fund invest.

Interval Fund. The Fund is designed primarily for long-term investors and not as a trading vehicle. The Fund is an "interval fund" pursuant to which it, subject to applicable law, will conduct quarterly repurchase offers for between 5% and 25% of the Fund's outstanding Shares at net asset value ("NAV"). Under normal market conditions, the Fund currently intends to offer to repurchase 5% of its outstanding shares at NAV on a quarterly basis. In connection with any given repurchase offer, it is possible that a repurchase offer may be oversubscribed, with the result that Fund shareholders ("Shareholders") may only be able to have a portion of their Shares repurchased. The Fund does not currently intend to list its Shares for trading on any national securities exchange. The Shares are, therefore, not readily marketable. Even though the Fund will make quarterly repurchase offers to repurchase a portion of the Shares to try to provide liquidity to Shareholders, you should consider the Shares to have limited liquidity.

Hedge Funds. The Fund will invest in private investment funds, or "hedge funds," which pursue alternative investment strategies. Hedge funds often engage in speculative investment practices such as leverage, short-selling, arbitrage, hedging, derivatives, and other strategies that may increase investment loss. Hedge funds can be highly illiquid, are not required to provide periodic pricing or valuation information to investors and often charge high fees that can erode performance. Additionally, they may involve complex tax structures and delays in distributing tax information. A shareholder will also bear fees and expenses charged by the underlying hedge funds in addition to the Fund's direct fees and expenses, thereby increasing indirect costs and potentially reducing returns to shareholders. There can be no assurance that the investment objective of a hedge fund will be achieved. A hedge fund may change its investment objective or policies without the Fund's approval, which could force the Fund to withdraw its investment from such fund at a time that is unfavorable. In addition, one hedge fund may buy the same securities that another investment fund sells. Therefore, the Fund would indirectly bear the costs of these trades without accomplishing any investment purpose. Moreover, certain hedge fund managers charge performance-based fees that may create an incentive to invest hedge fund assets in investments that are riskier or more speculative than the investments the managers would have selected in the absence of a performance fee. Because of the speculative nature of a hedge fund's investments and trading strategies, the Fund may suffer a significant or complete loss of its invested capital in one or more hedge funds.

General Economic Conditions and Recent Events The value of the Fund's or Alternative Fund's investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the US or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund or Alternative Funds may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation/deflation, changes in interest rates, lack of liquidity in the bond or equity markets, volatility in the equity markets. US or global markets may be adversely affected by uncertainties and events in the US and around the world, such as major cybersecurity events, geopolitical events (including wars, terror attacks, natural disasters, spread of infectious disease (including epidemics or pandemics) or other public health emergencies), social unrest, political developments, and changes in government policies, taxation, restrictions on foreign investment and currency repatriation, currency fluctuations and developments in the laws and regulations in the US and other countries, or other political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market.

026001j 0126