Rebalance Don’t Retreat: Alternative Strategies to Help You Stay Invested

Summary points:

- September has a reputation for being a scary month for the markets—but with the right asset allocation in place, it doesn’t have to be a scary time for investors.

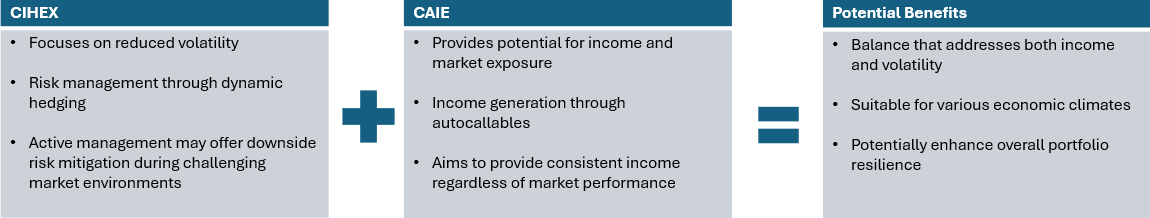

- Calamos alternative offerings are designed to navigate volatility, with the goal of providing a steadier ride through choppy equity markets. In this post, we highlight two of our innovative solutions—which can work independently or in tandem to help address investor needs. Calamos Hedged Equity Fund (CIHEX) leverages a dynamic options overlay seeking to capture equity market upside, while actively dampening downside, allowing investors to stay invested without absorbing the full brunt of market drawdowns. Calamos Autocallable Income ETF (CAIE) utilizes laddered autocallable notes with high coupon income (equity linked) to pursue high, stable monthly income; autocallable structure provides barriers that help mitigate principal loss.

- While each fund offers standalone benefits, a combination of CIHEX and CAIE can go a step further to help address investors’ key goals and concerns—income with reduced sensitivity to interest rates, exposure to market upside with less vulnerability to drawdowns, and the potential to enhance overall portfolio resilience.

It’s not surprising that investors feel uneasy in September—historically, it’s been the worst month to be invested in equities. Since 1950, the S&P 500 Index has averaged a 0.72% decline in September, and over the last decade, September has averaged an even worse -2% decline. Regardless of whether history repeats in 2025, there’s no doubt that investors have plenty to contend with this September: persistent inflation could spook the Fed from lowering rates later this month; low bond yields create a murky backdrop for income-oriented investors; and anxiety about slowing growth and stretched valuations have buffeted tech stocks.

Not surprisingly, we’ve seen many of the classic hallmarks of jittery markets: gold surged past $3,500, and the 30-year Treasury yield rose to 4.98%, reflecting a shift toward defensive assets as investors appear to be repositioning after a strong summer rally. The CBOE Volatility Index (VIX) jumped, crossing the 18 threshold, signaling elevated investor anxiety and potential for further downside.

Rebalance Don’t Retreat: Calamos Alternative Solutions Built to Address Volatility

In markets like these, we believe the best course is to find the right strategies that make it easy to stay invested. Since its founding in the 1970s, Calamos has sought to provide investors with the opportunity to capitalize on volatility, introducing a range of innovative alternative approaches in ETF and mutual fund structures.

Below, we highlight two—Calamos Hedged Equity Fund (CIHEX) and Calamos Autocallable Income ETF (CAIE). Both CIHEX and CAIE have distinguished themselves amid recent market turbulence by combining income generation with sophisticated risk management. This dual advantage has led both funds to outperform many traditional equity and income peers to date.

| Calamos Hedged Equity Fund | Calamos Autocallable Income ETF | |

|---|---|---|

| Investor focus |

|

|

| What the Fund seeks |

|

|

| Key Points |

|

|

| How the Fund works |

|

|

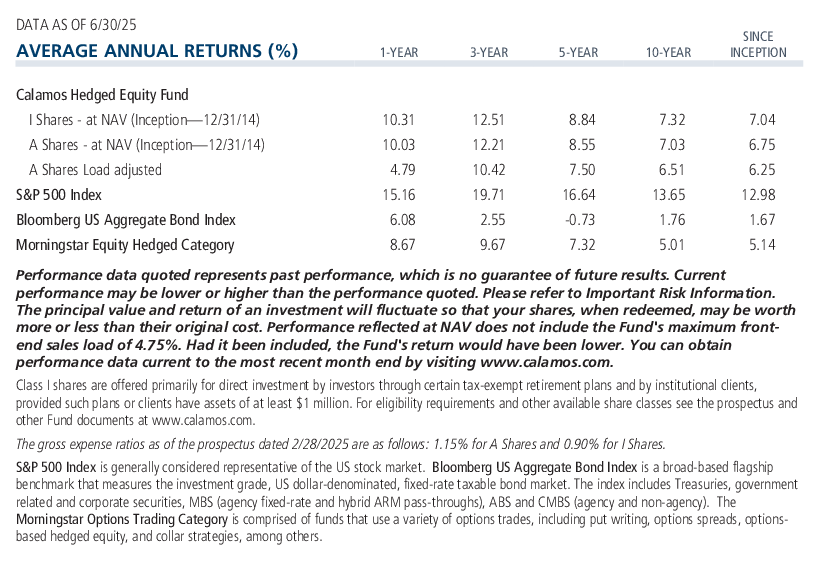

Past performance is no guarantee of future results.

Overall Morningstar Rating™ among 131 Equity Hedged funds. The Fund’s risk-adjusted returns based on load-waived Class I shares had 4 stars for 3 years, 3 stars for 5 years and 4 stars for 10 years out of 131, 98 and 57 Equity Hedged Funds, respectively, for the period ended 8/31/2025. Standard deviation for three years ending June 30, 2025 was 8.3% for CIHEX and 15.8% for the S&P 500 Index.

A Compelling Complementary Combination for Uncertain Times

Together, the funds offers the potential for growth and income with an opportunity for risk mitigation against market fluctuations in uncertain market conditions.

In conclusion

Periods of heightened uncertainty present critical decision points for investors. Rather than retreating, we believe these conditions call for thoughtful repositioning. Solutions like CIHEX and CAIE are designed to help investors remain engaged with markets, actively manage downside risk, and pursue meaningful income—all while maintaining long-term objectives. This balanced approach empowers investors to navigate volatility proactively and with confidence, making CIHEX and CAIE compelling solutions for portfolio resiliency and growth.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Autocallable Income ETF include: autocallable structure risk, contingent income risk, early redemption risk, barrier risk, authorized participant concentration risk, calculation methodology risk, cash holdings risk, correlation risk, costs of buying and selling fund shares, counterparty risk, credit risk, derivatives risk, equity securities risk, index risk, interest rate risk, investment in a subsidiary, laddered portfolio risk, liquidity risk, market maker risk, market risk, new fund risk, non-diversification risk, premium-discount risk, secondary market trading risk, swap agreement risk, tax risk, trading issues risk, valuation risk, and volatility target index risk.

Autocallable Structure Risk --The Fund’s returns are correlated to the performance of a synthetic portfolio of autocallable notes tracked by the Laddered Autocall Index.

Unmanaged index returns, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. Total return assumes the reinvestment of income. Current performance may be higher or lower than the performance data shown. Yields represented by trailing 12 month yield for:; Autocallable Income: MerQube US Large Cap Vol Advantage Autocallable Index. MerQube US Large Cap Vol Advantage Autocallable Index is not a proxy for Calamos Autocallable Income ETF (CAIE). The results of the MerQube index will differ to those of CAIE. Investors should consider the risks of investing in CAIE and review the prospectus prior to investing. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value of an investment will fluctuate so that your shares, when sold, may be worth more or less than their original cost.

Autocallable notes have specific structural features that may be unfamiliar to many investors:

--Contingent Income Risk: Coupon payments from the Autocalls are not guaranteed and will not be made if the Underlying Index falls below the Coupon Barrier on observation dates. This means the Fund may generate significantly less income than anticipated during market downturns.

--Early Redemption Risk: Autocalls in the Portfolio may be called before their scheduled maturity if the Underlying Reference Index reaches or exceeds the Autocall Barrier on observation dates. This automatic early redemption could force reinvestment of that portion of the portfolio at lower rates if market yields have declined.

--Barrier Risk: If the Underlying Reference Index falls below the Protection Level Barrier at the maturity of an Autocall in the Portfolio, that portion of the Portfolio will be fully exposed to the negative performance of the Underlying Reference Index from its initial level. This conditional protection creates a binary outcome that can result in sudden, significant losses if barriers are breached.

Weighted Average Coupon: The weighted average coupon of all autocallables as of last operation date. Total return assumes the reinvestment of income. Current performance may be higher or lower than the performance data shown. Yield represented by trailing 12 month yield for: Autocallable Income: MerQube US Large Cap Vol Advantage Autocallable Index. MerQube US Large Cap Vol Advantage Autocallable Index is not a proxy for Calamos Autocallable Income ETF (CAIE). The results of the MerQube index will differ to those of CAIE.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes, and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses, and are not available for direct investment. The S&P 500 Index is considered a measure of the US equity market. The Bloomberg US Aggregate Index measures the performance of investment-grade bonds. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests. VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options. On a global basis, it is one of the most recognized measures of volatility -- widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

The Morningstar Options Trading Category is comprised of funds that use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others.

Annualized standard deviation is a statistical measure of the historic volatility of a mutual fund or portfolio. Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Morningstar Ratings™ are based on risk-adjusted returns and are through 6/30/25 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2025 Morningstar, Inc.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

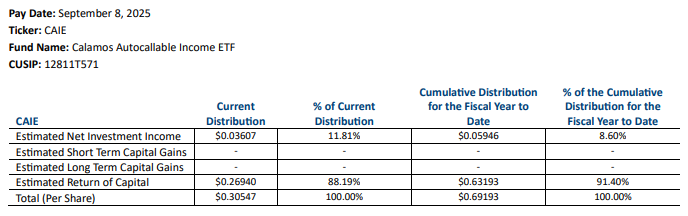

Distribution Information: CAIE

Complete notice may be found here